The latest data from TrendForce shows that monitor shipments decreased by 7.3% in 2023 to only 125 million units, which is lower than the pre-epidemic level. Looking forward to 2024, due to the low base period of shipments in 2023, coupled with factors such as the normal PC replacement cycle of 4-5 years, global monitor shipments are expected to increase by 2% annually to approximately 128 million units.

Dell monitor

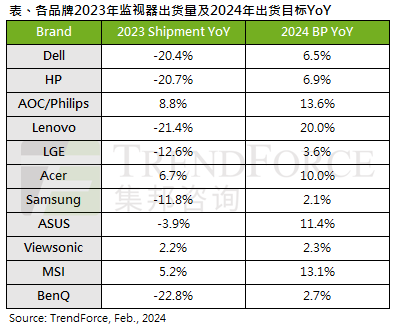

TrendForce pointed out that in the first half of 2022, the undigested demand for business orders in Europe and the United States will continue to ferment. By 2023, the business market demand will face a sharp contraction, resulting in the three major business display brands Dell (Dell), HP (HP), and Lenovo (Lenovo). ) shipments fell by 20.4%, 20.7% and 21.4% respectively year-on-year, with the declines exceeding 20%.

However, some consumer brands have achieved Global monitor shipments against the trend in 2023. Among them, AOC/Philips mainly benefited from the popularity of China’s e-sports market, with shipments increasing by 8.8% annually. Acer will be the first to quickly upgrade 60/75Hz products to 100Hz in 2023 with almost no price difference, driving shipments to increase by 6.7% annually.

TrendForce said that judging from the 2024 display brand shipment plans, the shipment targets of business and consumer brands are still conservative. Lenovo is the most aggressive in the business category, with an annual shipment growth target of about 20%; consumer brands AOC/ Philips, MSI, ASUS and Acer all have annual shipment growth targets exceeding 10%. On the other hand, Samsung Electronics, LG Electronics, and BenQ have more conservative shipment targets for 2024.